Saving shouldn't feel like a punishment. It shouldn't be a constant battle of willpower where you're asking yourself, "Can I afford this coffee?" or "Am I saving enough?"

Instead of thinking of saving as a sacrifice, think of it as a strategic build. A good builder wins by setting up the right system from the start. That means funding your goals first and letting that system—not your willpower—do the heavy lifting.

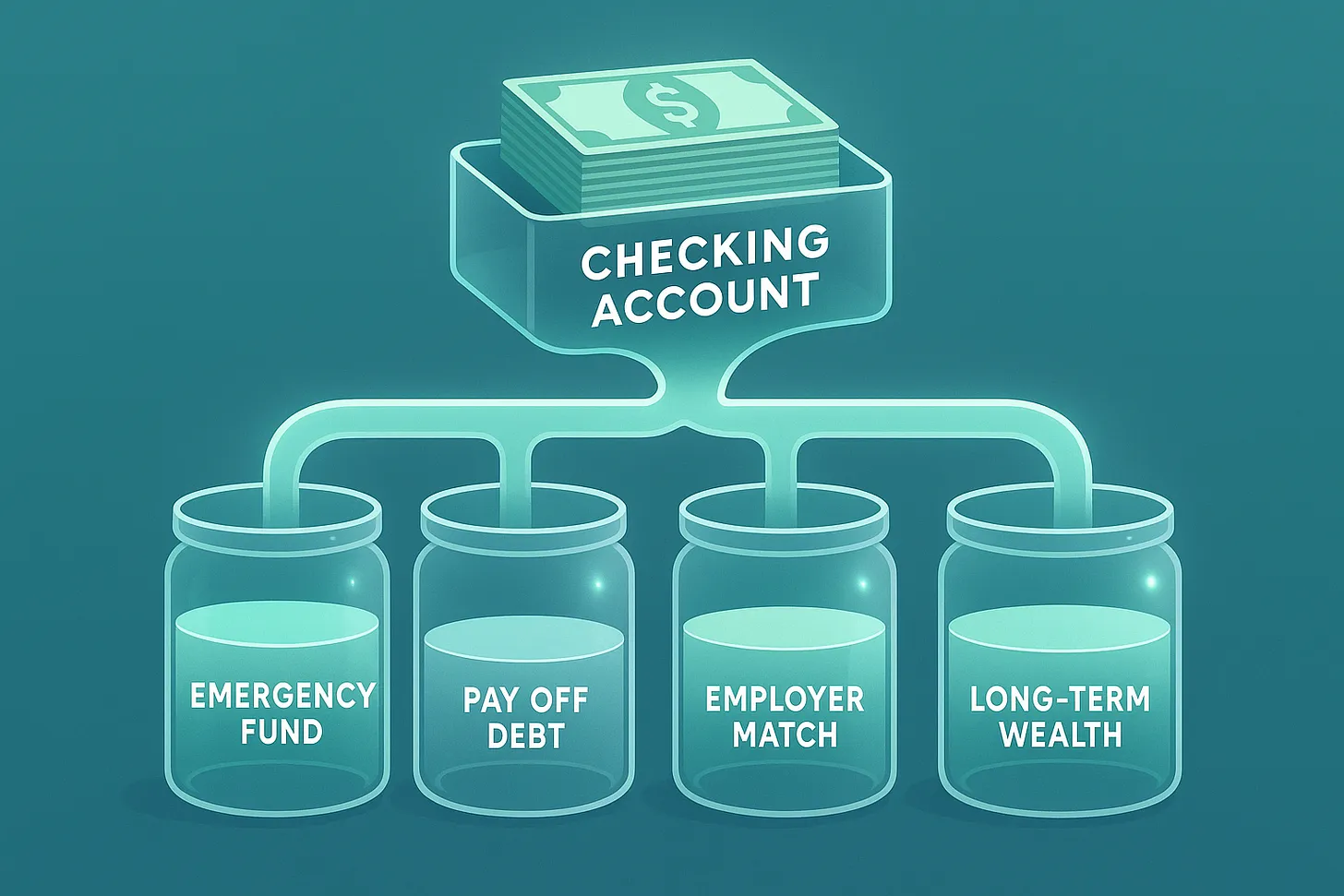

You're already doing the hard work of earning a paycheck. But once that money is in your account, what's the smartest move? What should you fund first: your emergency fund, your Roth IRA, or that credit card with a high interest rate? The confusion and information overload often lead to inaction and missed opportunities.

The Priority Stack: A Blueprint for Your Savings

This is where a strategic approach to savings allocation becomes your superpower. You don't have to guess or get overwhelmed by all the options. You just follow a clear set of priorities. Think of it as a blueprint for your money, designed to maximize every dollar's potential.

Build Your Emergency Fund

Before you do anything else, secure your financial foundation. This bucket should be filled first until you hit your target (ideally 3-6 months of essential expenses). Having this safety net means you can handle life's unexpected events without getting derailed.

Tackle High-Interest Debt

Once your foundation is solid, turn your focus to any unsecured debt with a high APR (over 10%). Paying this down is like getting a guaranteed return on your money—it's one of the smartest moves you can make. It frees up future cash flow for more exciting things.

Capture Your Employer Match

This is the closest thing to free money you will ever find. If your company offers a 401(k) match, contribute at least enough to get the full amount. Missing out on this is leaving money on the table, and a good builder never wastes free materials.

From Strategy to Action: Optimizing Your Wealth Engine

With the essentials covered, you can now focus on building long-term wealth. This is where your individual goals come in. You've heard people talk about Roth IRAs and brokerage accounts, and you know they're important—but which one is right for you?

A smart system can help you navigate these decisions based on your unique situation. For example, it can prioritize contributions to tax-advantaged accounts while considering your eligibility and student loan status. This ensures your money is growing as efficiently as possible.

The beauty of this system is that it adapts to your life. The logic is flexible, automatically prioritizing what matters most while respecting your individual circumstances and goals.

WeLeap automates this entire process for you.

We'll notify you when you can "Contribute $95 more this paycheck to capture the full employer match."

If you have a surplus, we'll suggest a move like: "Shift $100 to debt—saves ~$200 interest over 12 months."

And if you're close to an annual limit, we'll let you know: "You're close to the IRA limit; any overflow will route to Brokerage automatically."

That's what real growth looks like—steady progress that fits into your real life, not a rigid budget that makes you feel miserable.

💡 Your Takeaway

You don't have to guess how to save. By adopting a smart, tiered approach, you build a system that makes saving invisible and automatic; your future balance will notice.

👉 Ready to save smarter, not harder? Join the waitlist at www.weleap.ai — painless saving