Financial Resources

Expert insights, practical tools, and actionable advice to help you make smarter financial decisions.

Free Tools

Practical calculators and tools to help you make smarter financial decisions.

Articles & Guides

Deep dives, strategies, and insights to help you build a smarter financial future.

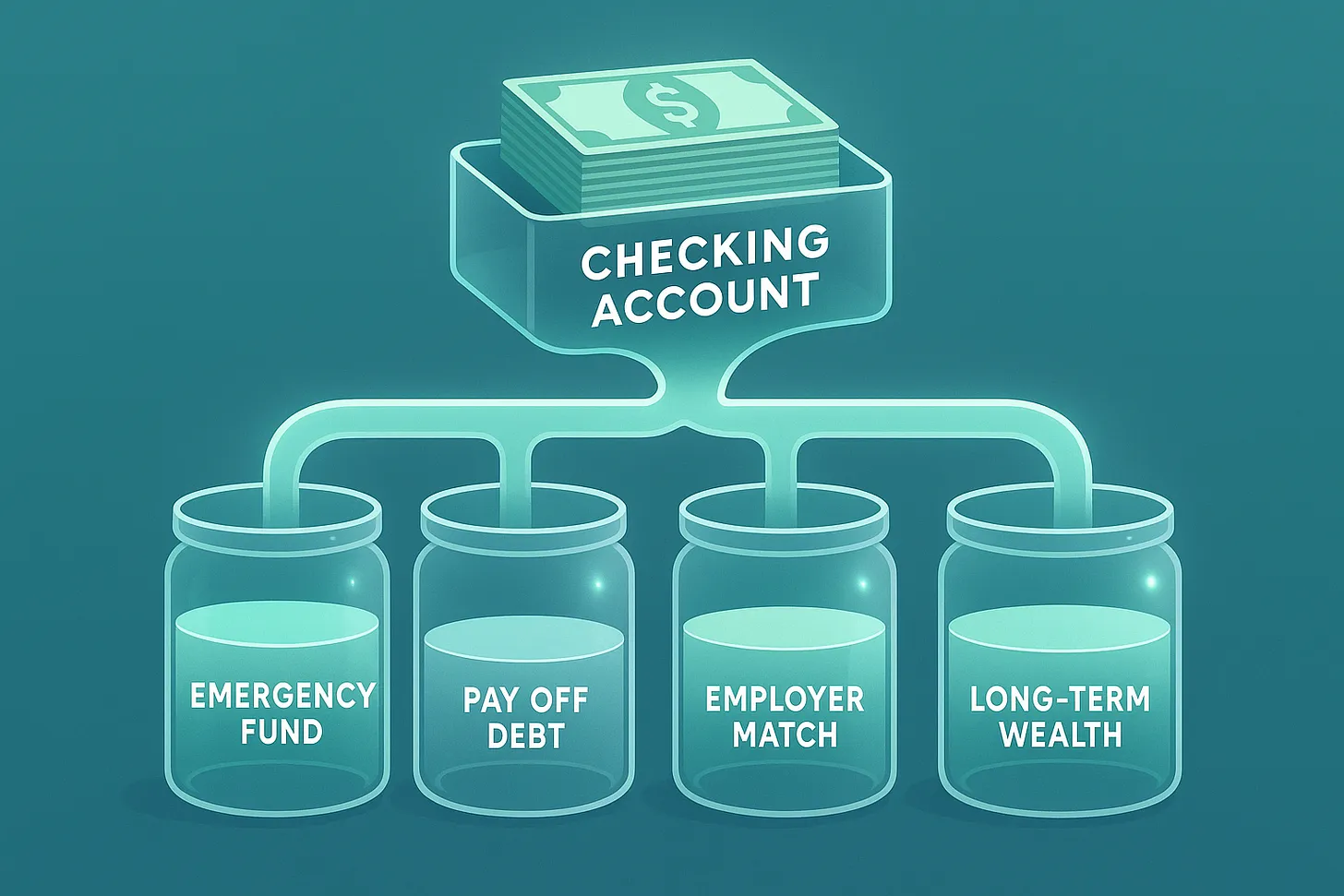

Income Allocation: The Blueprint to Make Your Paycheck Work Smarter

Tired of feeling behind? Learn the simple system to turn your income into a wealth-building engine.

Savings Allocation: How to Grow Your Savings Without Feeling the Pinch

Build goals into your plan and let automation make it painless. Learn the priority stack for strategic savings allocation.

Why Traditional Financial Tools Fail Builders

Explore the behavioral patterns that lead to poor financial choices and learn strategies to overcome emotional spending.

The Adaptable Money System: Stop Budgeting, Start Building

Why rigid budgets fail and how you can grow wealth with a dynamic approach.

From Awareness to Action: Escaping the Passive Budgeting Trap

You checked your budget, saw the pie chart, nodded in recognition—and kept spending the same way. Break free from passive budgeting and turn financial awareness into real action.

Financial Autopilot Isn't Lazy — It's Smart

True automation turns your priorities into rules that run in the background, freeing up brain-space while staying aligned with your goals. Learn how to build a system that works for you.

The Rent-Check Panic: Why Budgeting Isn't Enough (And What to Do Instead)

Learn why this happens and how to restructure your money habits for lasting control. This common experience has less to do with budgeting skills and more to do with how money flows through your life.

Building Your Emergency Fund: A Step-by-Step Guide

Learn how to build a safety net that protects you from life's unexpected expenses without derailing your financial goals.

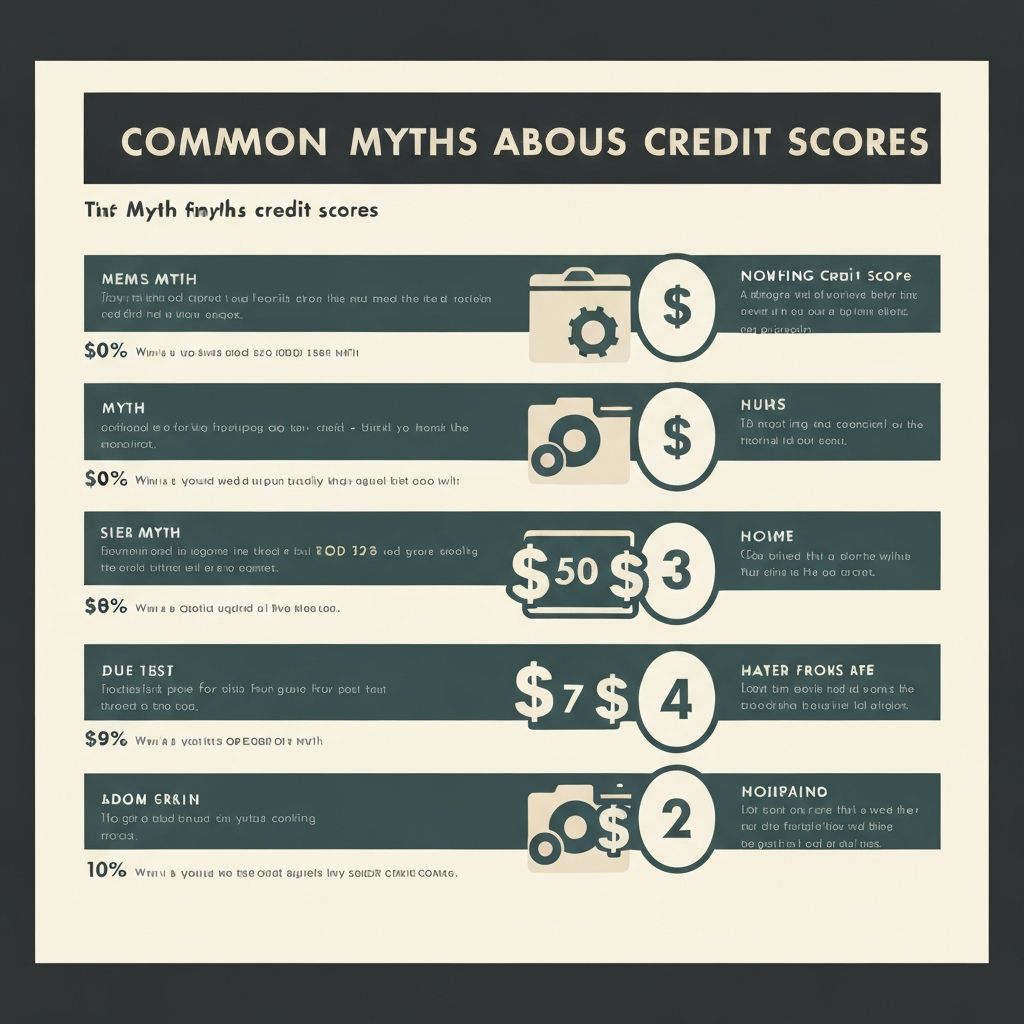

Credit Score Myths Debunked: What Really Matters

Cut through the misinformation and learn what actually impacts your credit score and how to improve it strategically.

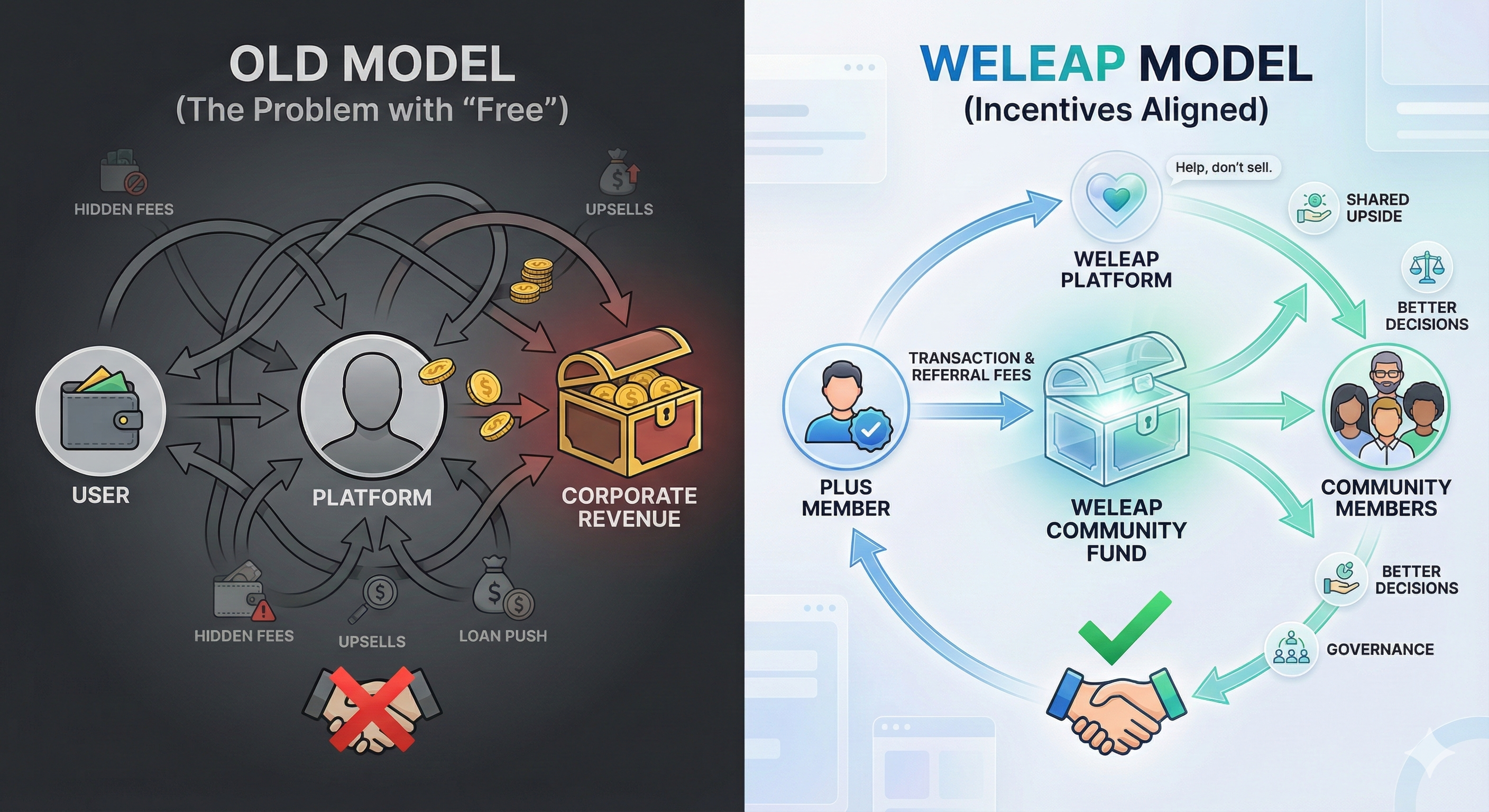

Why WeLeap's Pricing Is Different (and Built for You)

Most financial apps profit when you spend more. WeLeap breaks that model by aligning incentives with your success, not transactions.

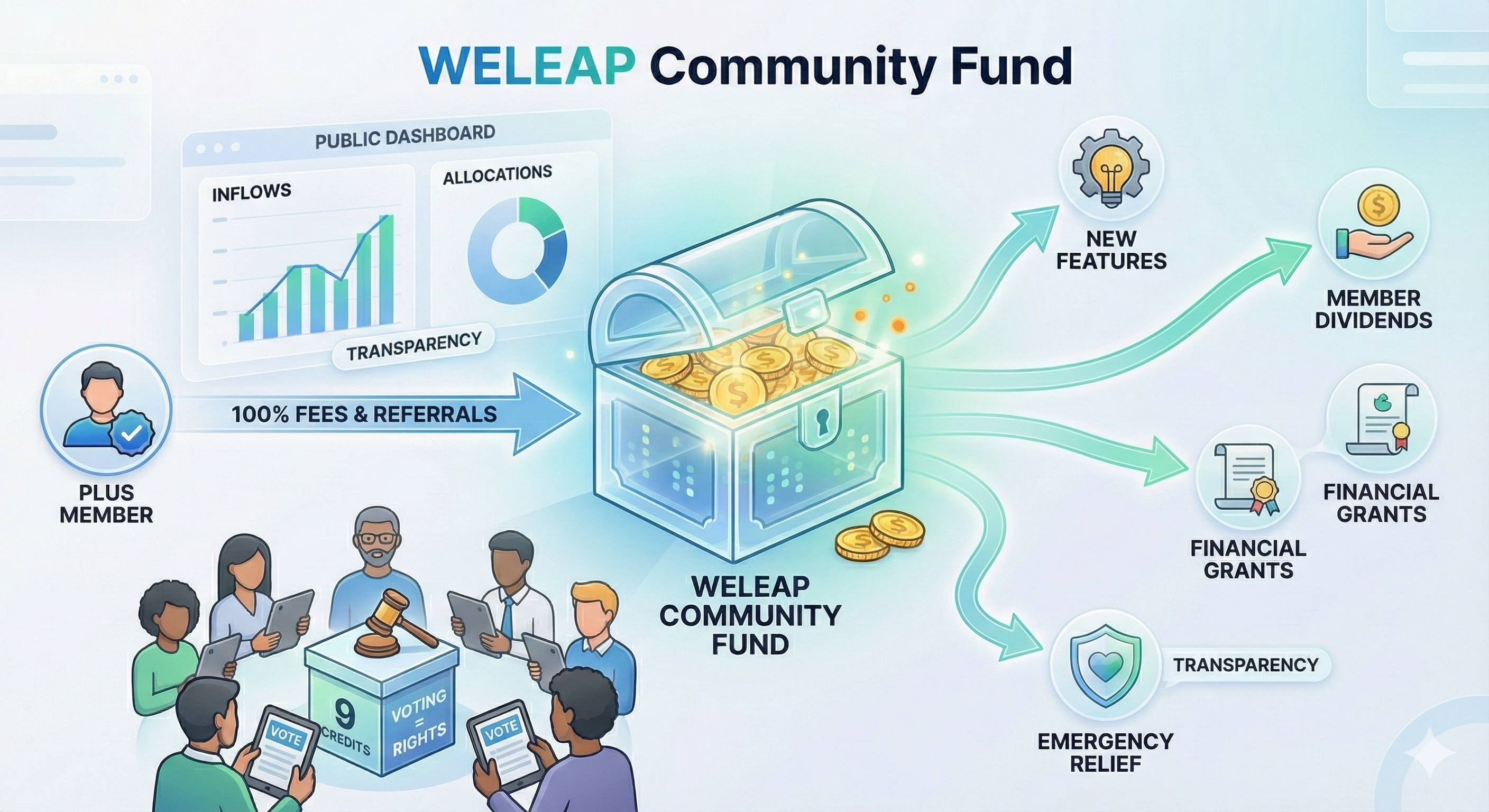

The WeLeap Community Fund — A Financial First

When you sign up for financial products, the fees flow back into your community—not corporate revenue. See how member governance works.

Stay Updated

Don't miss a Leap. Get one actionable financial tip every week—no spam, just strategy.